When considering the safest place for your money, there are several options available to you. Depending on what stage of life you are in, and your investor profile, there are a few options to consider.

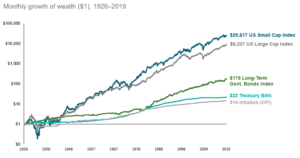

Many people believe that the safest place for your money is in the stock market. There is a good reason for that. Stocks have outperformed both bonds and CDs (certificates of deposit) over the long term, and they offer the potential for capital gains, along with the income provided by dividends.

Source: Darrow

While there are risks associated with investing in stocks, these can be managed by diversifying your portfolio across a variety of different companies and sectors. However, it is important for investors to avoid diworsification, through related diversification.

Additionally, you can reduce your risk by investing in mutual funds or exchange-traded funds, or limit your investments to defensive stocks. This type of stocks might help you to achieve greater returns while limiting your downside

The stock market has its risks, and equities always tend to be more volatile than bonds. In times of economic uncertainty, stocks can be volatile and lose value quickly.

Additionally, some companies may go bankrupt, leading to losses for investors. For these reasons, it is important to do your research before investing in stocks and to diversify your portfolio.

If you are uncomfortable with the risks associated with stocks, there are other options available. Treasury bonds offer a guaranteed rate of return, without the risk of losing money if the company goes bankrupt. However, these returns are not as high as those offered by stocks.

Here are the safest places for your money:

Safest places for your money

Every investment has its risks. Even treasuries that are considered risk-free investments, still have some risks. In finance, there are no free lunches, but there are investments that stand out for its safety. Here are some of the most common options when you think of the safest place for your money:

- Treasuries

- TIPS

- Corporate bonds

- Certificates of deposit

- Defensive stocks

- Precious metals

Treasuries

Treasuries tend to be the safest investment. This is because they are issued by countries, and it is highly unlikely that a country defaults on its debt. However, this is not impossible, and in fact, it has happened in the past.

Another risk associated with treasuries is inflation. If you plan to hold treasuries until maturity, inflation becomes one of the biggest risks. If the inflation rate is higher than the coupon you are receiving, you are investing money but losing purchasing power.

Advantages of treasuries

Treasuries are one of the most desired investment vehicles mainly due to how safe they are. However, there are more advantages. Here are a few:

- Highly liquid

- Tax advantages

- One of the safest places for your money

- Principal guaranteed at maturity

- Low volatility

Treasuries are one of the safest places for your money because they are backed by the United States Government. Although the risk of defaults still exists, it is practically non-existent. They are also highly liquid, which makes it easy to trade them.

Treasuries also have numerous tax advantages that might make them even more compelling investments.

Another advantage is that your principal is guaranteed at the end, and they also tend to be less volatile than other assets.

Disadvantages of treasuries

One of the main disadvantages of treasuries is the risk of inflation. If the CPI is higher than the coupon rate, you are receiving income, but losing purchasing power. In a sense, the value of your money is now less than what it was when you first invested.

Another advantage is that treasuries are very liquid, which makes them easy to transact. In case you want to dispose of your investment.

As always there is the risk of default. Although it is highly unlikely that the United States Government will default on its debt, it is a possibility that investors should always consider.

TIPS

TIPS or Treasury Inflation-Protected Securities are a unique type of treasuries, where the treasury coupon is adjusted based on inflation, as well as the principal paid at maturity.

The coupon rate is adjusted depending on the increase of the CPI (consumer price index). The principal received at maturity will also be adjusted for inflation. In case there is deflation, and the inflation-adjusted value of the principal is lower at maturity, the investor will still receive the same principal.

This allows you to invest your money safely, and completely remove the risk of inflation affecting regular treasuries.

What are treasuries without inflation?

TIPS or treasuries without inflation allow investors to invest in treasuries and still be protected or hedged against inflation. In periods of rising inflation, this tends to be one of the safest places for your money.

Not only will you receive interest payments adjusted to inflation, but also your principal is protected from inflation. Allowing you to keep the same purchasing power as before.

This makes TIPS an attractive investment option and one of the safest places for your money during inflationary periods. For investors who are worried about rising prices, it tends to be a great investment.

Advantages of TIPS

If you are looking for the safest place for your money during inflationary periods, TIPS are one of the best solutions available. The main advantages of TIPS are:

- The principal received at maturity is adjusted for inflation

- Coupon rate adjusted for inflation

- The principal is guaranteed even in case of deflation

- Less volatile than other assets

- One of the best investment vehicles that protect against inflation

- Low volatility

If you invest in TIPS, you are guaranteed your principal at maturity adjusted for inflation. The coupon payments are also adjusted for inflation, and even if there is deflation you will still get your principal at maturity. Similar to treasuries, TIPs are also very liquid, making them easy to transact.

Disadvantages of TIPS

Despite the advantages, TIPS also have some clear disadvantages. Here are some of the main ones:

- Lower coupon rate than treasuries and corporate debt

- Default risk

- Higher taxes if the coupon is adjusted for higher inflation

- If there is no inflation, it becomes a bad investment

- Very liquid

- Lower returns than other assets such as stocks

The main one is that they tend to have a lower coupon rate than regular treasuries or corporate bonds. If there is inflation, you need to also consider the higher taxes you will pay on the income generated by the coupon adjusted for inflation.

Finally, if there is no inflation during your holding period, TIPS become an inefficient investment vehicle. Because the interest you receive is less than other options such as regular treasuries and corporate bonds. Additionally, there is always the risk that the United States government could default on its obligations, which would cause investors to lose money.

Although a scenario of default is highly unlikely it is still a possibility.

Corporate bonds

Corporate bonds are also one of the safest places for your money. Corporations have several ways of raising capital, and one of them is by issuing bonds. Bondholders receive a coupon, as well as the principal at maturity.

If you are considering investing in corporate bonds, one of the most crucial things to do is to analyze the credit rating of the company issuing the bonds. Credit rating agencies attribute credit scores to companies based on their likelihood of default. For that reason, it is important to stick to companies with higher-grade credit ratings.

Although corporate bonds tend to be riskier than treasuries and TIPS, since it is more likely for corporations to default on their debt than governments, they also offer higher expected returns.

Advantages of corporate bonds

Corporate bonds have several advantages over treasuries and TIPS. Here are the most important:

- Higher expected returns

- Higher yield than treasuries and TIPS

The main reason an investor would consider corporate bonds over treasuries or TIPS is the higher expected returns. Corporations pay a higher yield and it makes it more attractive since you can generate more income.

Disadvantages of corporate bonds

The main disadvantage of corporate bonds is that they tend to carry more risk. Although it is nearly impossible for a government to go bankrupt, the same cannot be said for companies.

Investors should pay a lot of attention to credit ratings. Understand that companies with lower credit ratings or a higher probability of default will usually pay a higher interest. This is because investors need to be rewarded for the higher risk associated with corporate bonds of companies with low credit ratings.

Corporate bonds also tend to be more volatile than treasuries and TIPS.

Certificates of deposit

Certificates of deposit, or CDs are also a very safe place for your money. Guaranteeing stable returns, and offering safety.

What are CDs?

Certificates of Deposit (CDs) are a type of savings account that offers a fixed rate of return over a set period. They provide a measure of safety since they are insured by the FDIC up to $250,000.

CDs are a good option for investors who want to lock in a rate of return and don't mind locking their money away for a set period.

CDs also offer a safe place to invest your money, with relatively low rates of return. Again, it is important to do your research before investing in CDs, as the interest rate may not be competitive with other options available.

Defensive stocks

Another important alternative to consider, especially if you are younger and have a higher risk tolerance is defensive stocks. Stocks are by far the best performing asset class, and the higher returns make them attractive to investors.

However, there are many stocks to choose from. Some of them are highly volatile, and some tend to be stable and more similar to fixed-income investments. Some investors choose to focus on defensive stocks. Well-established companies, with consistent revenues, and profits that pay dividends.

Some of these stocks are also dividend growers, which is like owning a bond but with a rising coupon. Many investors use defensive stocks as a way to keep their investment in the best performing asset class, but at the same time ensure they get income in the form of dividends and experience lower volatility.

Factoring in the rate of inflation

When looking for the safest place for your money, you should also consider the rate of inflation.

What is inflation?

Inflation is a measure of how prices are changing over time. When prices increase, that's called inflation. Inflation can be caused by things like increased demand or a decrease in the supply of goods and services.

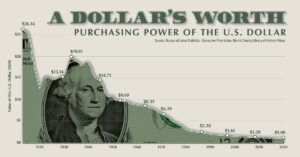

As more and more fiat money is created, the value of the currency starts to decline. We have witnessed the constant decline in the value of the Dollar, which translates into a lower purchasing power.

Source: Visual Capitalist

This is because there is more supply of money, chasing the same goods and services. Inflation can erode the value of your money over time, so it is important to invest in assets that will protect your purchasing power.

Treasuries offer a guaranteed rate of return, which can help to offset inflation. But if inflation is higher than the treasury yield, you are still losing purchasing power. Before investing your money, it is important to understand the rate of inflation and if treasuries, CDs, or any other investment vehicle can outpace it.

While it's impossible to say for sure, one thing is for certain: stocks become much less attractive when inflation is higher. If the dividend yield on the S&P 500 is lower than the interest on a treasury bond, it means that investors who buy stocks are essentially accepting a lower expected return to have the potential for capital gains.

Alternative inflation hedges

Some retail investors prefer other forms of inflation hedges such as precious metals. These are not for everyone and have their own unique benefits and risks.

Gold and precious metals

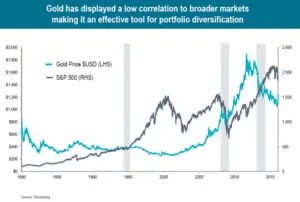

Some investors look at precious metals as the safest place for their money. Gold is a popular inflation hedge because it generally keeps pace with or exceeds inflation rates. Gold also has other benefits such as being a global currency and not being tied to a specific country.

Over time precious metals, especially gold tend to be accepted as safe investments that perform well during inflationary times. Despite being more volatile than treasuries, and TIPS, gold tends to be a way of protecting against market turmoil.

Gold investors or gold bugs also point to gold as the safest place for your money during inflationary periods. Despite having some advantages, the price of precious metals is derived based solely on supply and demand. It also does not produce any income. Especially during an economic downturn, when fear is on the rise and investors sell their stocks gold tends to perform very well.

Gold also tends to be a great solution to diversify your investment portfolio.

Risks

Gold is a physical asset and can be stolen or lost. It also has a limited supply which could cause it to become more expensive as demand increases.

Conclusion

It is important to remember that there is no one-size-fits-all answer when it comes to investment decisions. Every investor is different, and therefore their decisions should reflect that. There is no single answer to the safest place for your money.

It is important to always consider all of the alternatives available to make sure you make an informed investment decision.

The safest place for your money also varies depending on your circumstances.

If your goal is to invest while preserving capital, talk to a financial advisor to find the best option for you.