Equities are volatile and riskier investment vehicles, especially when we compare them with bonds. The volatility reflects the changes in supply and demand, and how the market is pricing in the growth of different stocks. According to the efficient market hypothesis, the market prices stocks according to their future earnings and the discount rate.

Therefore stock prices fluctuate depending on the estimated future earnings of the business, and the discount rate.

The market is forward-looking, any news or financial results of the company can make the stock fluctuate in price. Several internal and external factors drive the price of stocks, depending on the risk, and the financial estimates for each company.

Equities tend to be riskier investments when compared with real estate or bonds for example.

Comparatively, bonds are stable and less risky investments. Bonds also tend to be less volatile, but on the other hand, equities offer higher returns. Let's look at some of the key reasons why equities are riskier and more volatile.

Introduction to the equity market

The equity market refers to the market where companies issue stock to raise capital. Equities are the stakes or ownership rights of a company. Another synonym for equities is stocks.

The equity market is a term that refers to the stock market. This is where ownership of companies is traded.

The opposite of the equity market is the debt market. The debt market is where bonds are traded. Bonds are another way companies can use to raise capital.

Why are equities more volatile than bonds?

Equities are more volatile than bonds for a number of reasons, such as:

- Uncertainty regarding the future

- More prone to systemic risk

- Higher correlation with the economic environment

- Prone to news affecting the stock price

- Uncertain return

- Changing projections

- Legislation can affect the stock price

Bonds are simply a form of debt. A bondholder is almost always guaranteed to receive its principal when the bond matures, as well as the coupon. Bonds can still be volatile but since there are fixed payments like the coupon and the principal at maturity the price fluctuations are not as severe as in stocks.

Warren Buffett has one of the best explanations for the difference between bonds and stocks. According to Warren Buffett, stocks are bonds with a variable coupon and an uncertain principal payment at maturity.

This is perhaps one of the best ways to explain why stocks are more volatile than bonds. The coupons in stocks are earnings. Since the earnings are constantly fluctuating, and being projected by analysts, this causes stock price fluctuations. At the same time, the terminal value of the stock or the principal you would receive when you finally decide to sell is unknown.

This is the key reason that makes stocks more volatile than bonds. The uncertainty surrounding stocks forces their price to constantly adjust.

Why are equities riskier?

Equities are riskier due to the price sensitivity and how it translates into volatility. Although volatility and risk are two entirely different things, they have an effect on the stock price. The higher volatility in stocks due to the uncertainty surrounding them makes them riskier investments.

Stocks also tend to be riskier as their prices fluctuate more often.

Here are a few key factors that make equities riskier:

- The demand, and supply that is affected by company performance, growth, competitive advantage, market risk, and many other factors.

- Financial risk means a company’s financial performance such as achieving growth targets, revenue, net profits, and maintaining key financial performance ratios.

- The rating risk comes from the total performance of a company, and how it can affect the credit rating and worthiness of the company.

- The economic and market risks are external forces that can quickly influence prices.

All of these factors combined mean equities are riskier investments. The good news for investors is that high risk means a higher expected return.

Why are equities riskier than bonds?

Equities are riskier than bonds because the returns are more unpredictable. Investing in a bond gives you a fixed coupon payment and your principal at maturity. Investing in stocks does not guarantee any payment, and although there is no maturity on stock it is impossible to say exactly what its terminal value will be.

Bonds are also debt instruments, that allow bondholders to have a claim over the company’s assets. In case a company goes bankrupt, bondholders will be the first to get paid. Stockholders are the investors facing higher risks.

Stock prices reflect the company’s financial performance, and anticipated bad performance news will negatively affect the share price.

Market and economic risks also affect stock prices directly. Even if a stock performs well, the market perception about its performance matters. So, if the market perceives a stock as volatile, it will become riskier.

Socks are also riskier due to several other factors such as:

- Inflation risks

- Demand-supply

- Political risks

- Obsolesce risks

Bonds also face different types of risks, but they are safer investments. Historically bonds have shown more stability and lower risk than equities. The risks with stocks and bonds are somewhat correlated although stocks are clearly riskier and more volatile.

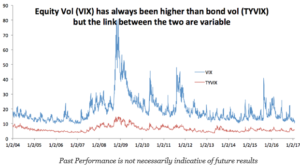

Here is a historical comparison between the volatility in equities (VIX) and treasuries (TYVIX). It should be important to note that treasuries are government-issued bonds and they are not as volatile or risky as corporate bonds.

Why are bonds more stable than stocks?

The main reason why bonds are more stable than stocks is that bondholders have priority over shareholders in the case of bankruptcy. Another reason that explains why bonds are stabler is the fact they have a fixed payment attached to it, and a maturity date.

When you invest in stocks, the payment or earnings is variable, and the terminal value is unknown. This explains why stock prices are more volatile and represent higher risks to investors.

Example:

Let’s consider investor A, that invested in stock of company XYZ, and investor B that has bonds of the same company. If the company XYZ presents bad results and misses earnings estimates this could make the stock drop. However, if the company is in a sound financial situation, and the balance sheet is not overleveraged, their bonds might not even fluctuate that much in price. This reflects that even if the company does not achieve a certain threshold of earnings, it will still be able to pay its debt.

Why are bonds less volatile?

Bonds tend to be less volatile because they are dependent on the company’s ability to pay its debts. Stock performance is dependent on the ability of the business to generate earnings consistently. Therefore any changes on the estimates for the company can create volatility in the stock price.

It is also important to make the distinction between government, and corporate bonds. Both present different levels of risk, volatility, and expected returns.

Government bonds such as T-bills are virtually risk-free. It makes them less volatile as compared to any other investment, not just stocks.

Corporate bonds may carry risks. The biggest risk factor for bonds is the credit rating of the issuer. If the corporation’s credit rating is strong and it is financially stable, its bonds will have positive credit ratings as well.

Bonds are fixed-income instruments. Bondholders are typically financial institutions and retail investors also look for fixed income through bonds. Therefore bonds are not traded like stocks. Since their investors are using it as a source of income. Stocks on the other hand are more driven by emotions such as fear and greed.

It means the demand-supply, credit risk, and financial risks are considerably lower for bonds when compared with equities.

Are bonds a better investment than stocks?

Every investment is different, depending on your investor profile. Some investors might even choose to diversify between bonds and stocks and run a mixed portfolio of fixed income and equities.

Both stocks and bonds have a place in different portfolios, but it all boils down to these main things:

- The risk you are willing to take

- Ability to deal with volatility

- Desired returns

- If you need the money you are investing

Bonds are less volatile and less risky than stocks. However, it means a lower expected return. Also, bonds are not entirely risk-free investments. As there is no guarantee that the issuer will not default.

Bonds carry interest rate risks, and are susceptible to high inflation since they carry a fixed coupon payment. When interest rates increase, bond prices fall, reflecting the need to adjust expected returns.

Some bonds are callable. It means bond issuers can call bonds and repay debts early. That would result in the loss of fixed income for investors.

On the other hand, stocks are riskier and more volatile. However, in the long-term, stocks outperform bonds and have much higher returns.

When you invest in stocks you are essentially owning a small part of a business. Investing in bonds just means you are a debtee.

If investors perform their due diligence before investing in stocks or bonds, they can reduce their investment risks.

An ideal way of balancing between equities and stocks is to keep both investments in the portfolio. Stocks would offer higher returns and bonds would offer diversification and stability to the portfolio in the long term, while also generating a fixed income.

Conclusion

It is clear now why stocks are clearly riskier and carry more volatility than other asset classes. However, despite the risks and the price fluctuations stocks are still the best performing asset class over very long periods of time. Overall, they remain the most interesting and attractive investment vehicle.

Investors should learn to deal with the volatility and the possible risks of investing in stocks. As it is one of the simplest ways to generate sizeable returns over the long term.