Whether you are an investor or a trader, it is important to understand the differences between sell to open vs sell to close. It is very similar to the difference between buy to open and buy to close, let's look at the differences.

Sell to Open

Sell to open refers to the opening of a short position for a derivative transaction. The phrase is usually associated with creating a short position for options contracts.

The investor in options contracts initiates a short position when anticipates a decrease in the value of the option contract. The investor can take the short position for a call or put contract.

Like any other options contract, the arrangement will have an investor with the opposite position. The long investor will be hoping for an increase in the value of the options contract. This means that he will expect an increase in the price of the underlying asset if he buys a call or a decrease in the price of the underlying asset if he buys a put. Hence the option contract’s value.

Sell to Close

A sell to close option refers to closing out a long position taken by an investor earlier. Sell to close is the transaction that takes place when selling an options contract. Simply, it is the complete act of a long position by an investor.

The sell to close transaction can be performed for a call or a put. However, the exercised or sell to close position for both options will vary.

Sell to open: call and put options

Every options contract will have two parties and their trading position will be offsetting.

Call Options

An investor will have a short position for a call will sell the options contract. The investor will create a “sell to open” transaction. The investor anticipates a fall in the price of the underlying asset and tries to sell the contract to earn the premium as a profit.

The counterparty of the call option will have a long position and will buy the contract. The second party will be hoping for an increase in the price of the underlying asset and take profit in the form of an option premium.

Put Options

The investor willing to take a short position with a put option will be selling the contract. The investor of a short put position will initiate the “sell to open” transaction.

The counterparty of a put option that takes a long position is buying the contract. The second party will be hoping for a decrease in the price of the asset.

The investor of a sell to open contract will receive an option premium. The options premium comprises the intrinsic and extrinsic value of the contract.

The extrinsic value will increase with the time decay and volatility of the underlying asset. The greater the time till expiry and volatility of the asset, the higher will be extrinsic value.

For a call option, the intrinsic value of the contract will increase if the asset’s price rises above the strike price. Conversely, the intrinsic value of the put option will increase if the asset’s price falls below the strike price.

Sell to close: call and put options

Sell to close is the execution of closing order for a long position taken in a call or put options contract. Since the investor already owns the contract, the sell to close represents exiting the contract.

An options contract owned by an investor can be in one of three positions:

- The options contract is in the money and the investor can sell or exercise the option

- The contract is out of the money

- An option contract is at the money, the investor can sell or close the contract

For long call options, the investors will be willing to execute the sell to close if they do not wish to hold a bullish position. Conversely, investors will execute the sell to close for a long put option when they no longer anticipate a bearish position of an asset.

Most investors will execute a sell to close when an options contract is in the money. They can exercise the contract or execute a sell to close.

A sell to close execution over-exercising the option will:

- Save commission costs for investors

- Retain extrinsic as well as the intrinsic value of the options contract

- Help investors avoid spillage risk of an asset with low volume and high volatility

Key differences between sell to open vs sell to close

Here is a quick summary of key differences between sell to close vs sell to open:

| Sell to Open | Sell to Close |

|

|

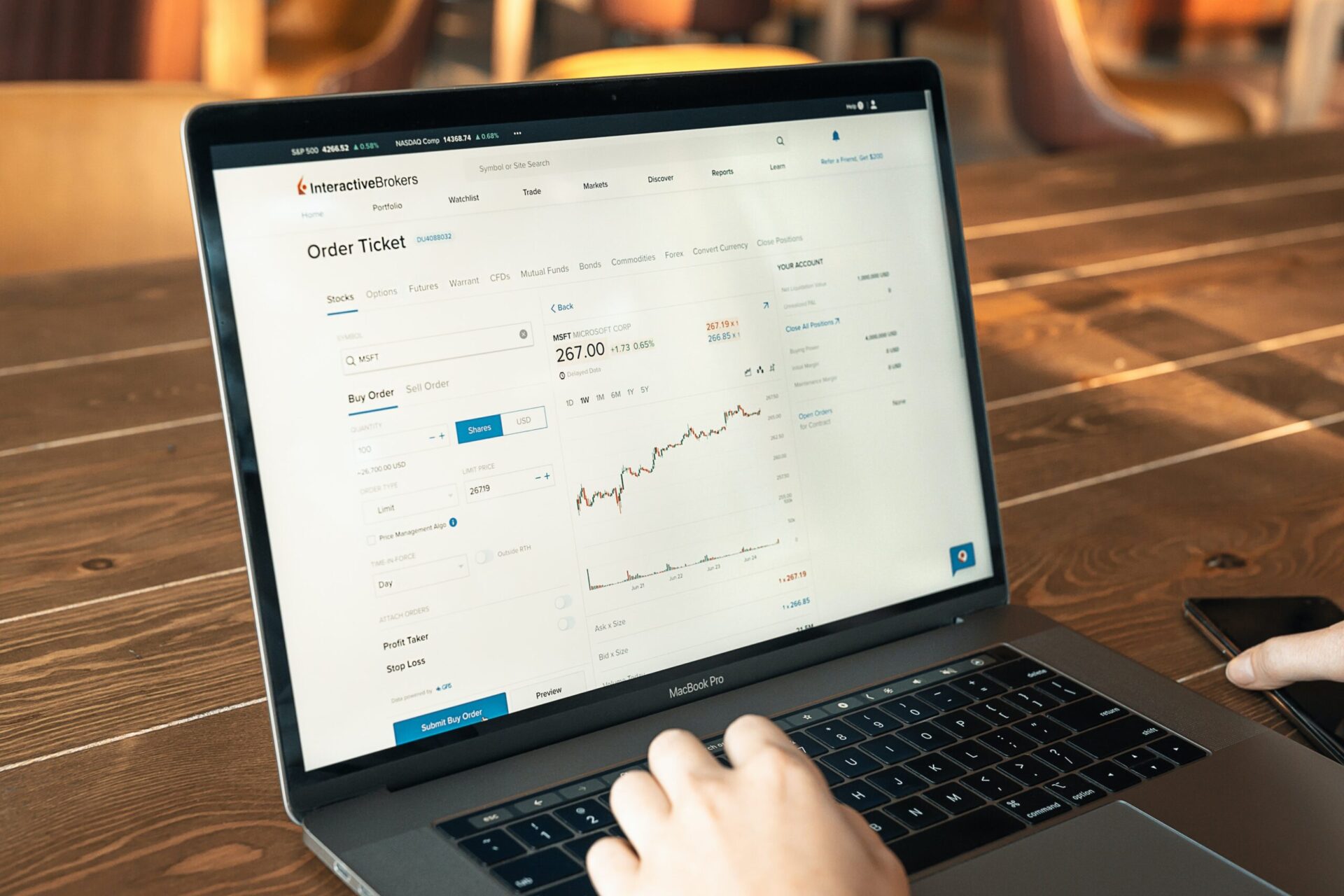

Image source: Unsplash