The calendar spread is a market-neutral strategy. It is a suitable strategy for investors that anticipate different volatility levels at different points for an underlying asset.

Definition of calendar spread

A calendar spread is an options trade strategy that involves buying and selling two options for the same underlying asset with the same strike prices but with different expiry dates. The calendar spread strategy involves buying and selling the same options (either call or put). This strategy is also called time or horizontal spread. If both contracts have different strike prices, it will be called diagonal spread strategy.

How does a calendar spread work?

An investor should first analyze the current market sentiment and forecast for the coming months. Calendar spreads would involve buying and selling two same options contracts with the same strike prices.

Depending on several factors including the market sentiment whether it is predicted to be bullish or bearish, the investor can take:

- A market-neutral position

- A short-term position of being market-neutral and a long-term position with an anticipated directional price move

Generally, in bearish markets, investors would use calls and in bearish markets, they would use puts. Some traders would also like to set the trade with at-the-money options.

The calendar spread strategy aims to take advantage of favorable movements in volatility and time decay for options contracts. Thus, the strike price should be as near the stock price as possible.

Commonly, traders sell short-dated options and buy long-dated options that reduce the cost of the long-dated options contract. The investor can go short on the front-month option that will reduce the cost of later-month options than buying a standalone long-term options contract.

Ideally, an investor would use long calendar spread options and would want the short-term options contract to go out of the money. Thus, the contract will expire worthless. The strategy will then be left with only one long option contract.

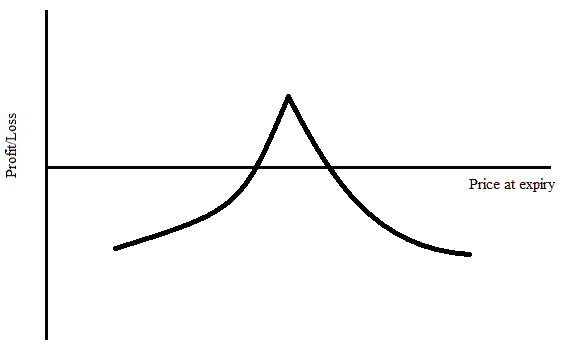

Maximum gain and loss

Investors sell the short-dated options and buy the long-dated options. It means the maximum loss on a calendar spread strategy is the cost to enter the trade setup. A calendar spread would only suffer a full loss if the option sold incurs a significant loss that cannot be offset by the long-dated option.

The maximum gain for investors will come when the stock price falls below or moves above the strike price, depending on if it is a put or a call, for the short-dated contract. To achieve the maximum gain, the short-dated option must expire worthless, and the long-dated options must be at the money.

Once the short-term options contract expires, the investor is left with a long call position. It has no upper limits for profits theoretically.

Risks with calendar spreads

A significant increase in the price of an underlying asset price is risky for a calendar spread strategy. Investors must plan the calendar spread strategy carefully and consider a few major risks involved.

Risk of early assignment

Short options contracts have always a risk of early assignments. It happens when a short options contract is in the money. Usually, if there is a dividend announcement and the ex-dividend date is near, the risk of the early assignment will be higher.

Time decay risk

Calendar spreads are positive theta. When all other factors remain constant, calendar spreads make a profit with time decay.

Short-term options contracts suffer a higher theta risk. However, the long-dated contract faces lower theta risk that reduces the total theta risk associated with a calendar spread strategy.

Volatility risk

Generally, investors would benefit from higher implied volatility since they hope to make profits from the long-dated contract once the short-dated contract expires.

If the position is positive Vega, will benefit from an increase in implied volatility. The converse is also true that the position will suffer losses if it’s negative Vega.

Advantages of a calendar spread strategy

The calendar spread strategy offers several advantages to investors.

- It is an inexpensive strategy for investors of the long options contract

- The downside risk of maximum loss is only equal to the cost of setting up the trade

- It can be used as a cheaper alternative to covered calls

- Has positive Theta and positive Vega risks

- It can be adjusted several times by investors

- It is a risk-averse strategy

Disadvantages of calendar spread strategy

A calendar spread strategy also comes with some disadvantages for investors.

- A significant price movement in either direction can affect the profits of the trade because of the Gamma risk

- It poses a risk of early assignment with the short-dated contract

- The strategy has limited upside benefits in the short term

- The strategy requires continuous monitoring and adjustments

Image source: forex