A crowded trade is a commonly used expression when a trading position is owned by a large number of investors. Therefore it is considered to be "crowded."

Such situations emerge when traders become so persuaded of the position's rationale and probability of success that they grow complacent. Crowded trades are not only driven by the assessment of potential returns, but also by herd behavior. However, crowded trades can be risky, either on the long side or the short side.

Why is a crowded trade risky?

When too many traders take one side of a trade, it becomes expensive to follow suit. It is something that happens far too often among hedge funds, as usually, they tend to have similar views on how a few assets will trade. The use of leverage also increases the degree to which a crowded trade gets crowded.

Crowded trades are often an enticing proposition. They start with the probability of returns, with a low expected loss. However, as more investors and traders pile on to the trade, the returns are expected to diminish. As the trade moves in the intended direction, more retail investors and traders will take the same position. Herd behavior will then drive the price even more to the direction it is expected to go.

Returns of portfolios exposed to crowded trades

The distinction in average returns between portfolios categorized by high crowdedness and low crowdedness positions is significant. Also, the variance in realized portfolio returns is separate from other traditional risk variables.

Furthermore, hedge fund crowdedness exposure is frequently considered. When it comes to long positions the crowdedness of certain positions is not as important. However, short positions can be extremely influenced by a crowded trade. As we have seen with Gamestop, and how multiple hedge funds crowded together on one single short trade can be extremely risky.

Therefore a short position should be considered not only on the basis of its rationale but also if it is a crowded trade. There are also other consequences of crowded trades, particularly in short positions. If too many market participants are taking short positions, then the cost to borrow the shares increases. As there are fewer available shares to short.

Considerable exposure to crowded trades also contributes to tail risk. Since funds with bigger exposures face proportionally larger drawdowns within periods of high volatility. These factors should be considered when managing a portfolio.

Crowded trades and bubbles

Crowded trades are frequently interconnected to bubbles. If investors can spot a bubble early enough, they can benefit from the price increase. However, in order to benefit from a bubble, investors must leave the bubble until the sell-off erodes all of the paper profits.

Crowded trades might help investors and traders identify bubbles. Asset concentration has been demonstrated to be related to the creation of bubbles. Another way to identify a bubble is through the method of relative value. This helps to distinguish a crowded trade that happens during the run-up of a bubble, from crowding that happens after the sell-off of a bubble - commonly described as a dead cat bounce.

Neither measure is adequate by itself to detect the whole cycle of a bubble. However, when used together, both metrics can help investors and traders identify bubbles in sectors, markets, and certain assets. Crowded trades are driven by herd behavior and fear of missing out (FOMO). Using these metrics you might be able to assess the turning point of a bubble.

As investors and traders attempt to exit their positions at the same time, the trade becomes crowded but in the opposite direction. Revealing how overpriced the asset was.

Crowded trade example

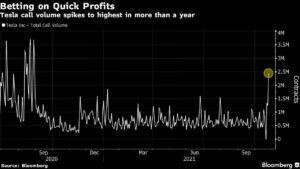

A recent example of a crowded trade is Tesla stock. Never before have we seen a stock that has a daily volume of options as high as Tesla. There is nothing that can effectively stop it, and the gamma squeeze has been the main reason behind the surge in price. The surge in call options trading in Tesla remains the main driver of the movement upwards.

Source: Bloomberg

Tesla has become the most crowded trade in the whole market. It is unclear when it will reverse, or if it will ever reverse. An unprecedented FOMO-driven trade, that is grabbing the attention of every market participant.

Image source: Japantimes