A stock split happens when a company divides its existing shares into an increased number of shares without issuing new shares or diluting its shareholders. This is a fairly common practice that companies use to maintain their share price lower and increase the liquidity of the stock.

Let’s look at why companies do stock splits and if that is a good indicator for investors.

What is a stock split?

A stock split is a process where companies split or divide their existing shares into more shares. It increases the number of outstanding shares for a company and for shareholders as well. Stock splits need to be approved by the board of directors, who decide the date on which the shares are split.

A stock split increases the number of shares the company has by a certain multiple, and therefore it affects the stock price, which tends to reflect the valuation the company had previously.

The lower stock price also attracts more retail investors, who were previously unable to invest in the stock due to its higher price. At the same time, since the price of the stock is now lower, and there are more investors that can possibly buy and sell the stock, the liquidity is increased.

How stock splits work

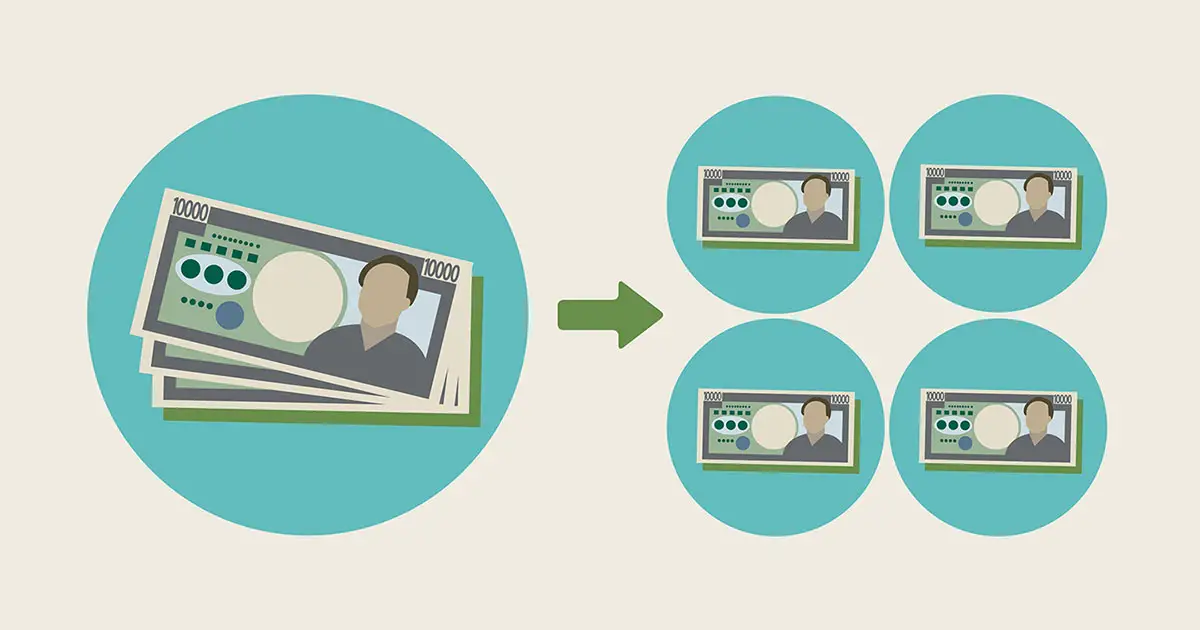

Stock splits increase the number of outstanding shares by a specific factor, and they will usually be referred to as an X-for-1. The X is the factor by which the shares are multiplied. One of the most common stock splits is a 2-for-1, which doubles the number of shares.

Every shareholder will get the same proportion number of additional shares as declared by the company, and theoretically, the market capitalization of the company does not change. Since the increased number of shares will make the stock price revert to a level that reflects the same valuation the company had prior to the split.

For example, a company with 1,000 outstanding shares will now have 2,000 outstanding shares after the stock split. An investor that had 100 shares will own 200 shares after the 2-for-1 split.

If the stock price before the split was $10 a share, after the split, the shares will trade somewhere around $5 to reflect the increased number of shares available.

As a shareholder, your shares will still have the same equity value as before, even if you own more shares after the stock split.

Why do companies do stock splits?

There are two main reasons why companies do stock splits:

- Attract retail investors

- Increase liquidity

Attract retail investors

A company may want to decrease its share price intentionally because it makes it easy for retail investors to buy the stock. A high individual share price may be impossible for retail investors to invest in the company, and stock splits lower the price so that every investor is able to buy the stock, even with a small portfolio.

Companies always try to make sure that their share price does not get either too high or too low, and one of the ways of doing it is through a stock split.

This happens for two reasons. On the one hand, you want to ensure the price is not too high to attract retail investors to invest in your company’s stock, and on the other hand, a low share price could give a wrong impression about a company, like it is a penny stock.

A very low share price makes the company look like a penny stock, and it prevents the stock from being listed on certain stock exchanges. So when stock prices are too low, companies may also choose to conduct a reverse stock split, which decreases the number of outstanding shares.

Increased liquidity

A stock split will result in lower share prices and increased trading volumes because now there are more shares available to be traded, and their individual value is also lower. Therefore a stock split also increases the liquidity of the stock, and it can also help companies reduce the volatility of the stock price when the share price is too high and the traded volumes are low.

High price volatility and low liquidity can prevent some investors from buying the stock, as they might perceive it as a risky investment, and therefore they want to avoid those stocks.

Stock split and valuation

It is crucial to understand that a stock split has no fundamental impact on the company’s valuation, and while the shares might trade higher after the stock split is announced, they usually revert to a level that reflects the same valuation prior to the split.

Stock splits do not increase the market capitalization or valuation of the company, and are merely a way of increasing liquidity and attracting retail investors.

Do you lose money when a stock splits?

Existing shareholders neither gain nor lose money when a stock splits, as their ownership of the company remains unchanged. However, after the stock split is announced, the stock price tends to go up which may help investors make money.

Stock split vs share dilution

The critical difference between a stock split and share dilution two concepts is dilution. When a company issues new shares, it is diluting existing shareholders. This means that you will control the same number of shares, but because the share count increased, your ownership of the company is reduced.

A stock split simply increases the number of shares for all the shareholders. Issuing shares can be detrimental for investors, as the value of their equity is reduced. On the other hand, stock splits are just a way to make the stock more attractive.

Is a Stock Split Good?

A stock split is considered good for the company and its investors, because it increases liquidity and usually pushes the stock price higher when the stock split is announced. This is beneficial for the stock and its shareholders, but it does not affect the market cap or valuation of the company in any way.

For individual investors, their ownership of the company remains unchanged even after a stock split, and therefore it does not have any real impact on the value of their investments over the long run.

It is essential to understand that neither a stock split nor a reverse stock split will affect the intrinsic value of your shares. The number of shares might increase or decrease, but you essentially control the same percentage of the company as you did before.