Not every investor is able to beat the market, and underperformance is something that even the most successful investors have to deal with. Even if have a long-term record of overperforming the market, there will be periods of underperformance. But what is the best way to deal with underperformance?

In this guide, we’ll analyze the possible causes of portfolio underperformance and the best approach you can take to deal with it.

What is portfolio underperformance?

Portfolio underperformance represents a period of time where a portfolio's returns are lower than its comparative benchmark. There are several reasons that could explain why a portfolio is underperforming, from portfolio construction to diversification and even periods of market underperformance in some sectors.

Understand that underperformance is normal

Underperformance in the short term is also common and sometimes it is not a sign that there is something with your portfolio. Price fluctuations in stocks or funds over a short period of time are usually just noise and should be taken lightly.

Underperforming even during a period of a few years is common, take for example Warren Buffett’s underperformance during the late ’90s is an example. Even some of the most well-known financial news outlets were questioning the Oracle’s ability to make investment decisions, and in retrospect, it was just a sign that the dot com bubble was about to pop.

The importance of choosing the right benchmark

One of the most important aspects to consider when analyzing the performance of your portfolio is the benchmark that you choose to use for comparison. When we talk about outperformance or underperformance there is always a benchmark that needs to be used as a comparison.

Choosing the right benchmark is crucial because you need to compare your portfolio’s performance with a benchmark that is similar. So for example, using the S&P 500 as your main benchmark when you have a portfolio with bonds and stocks does not make any sense.

In the same way that if you are investing in small caps, using the S&P 500 as your benchmark will also not be the best benchmark to compare your performance against, you should instead use the Russell 2000, which is made up of smaller companies.

How common is underperformance?

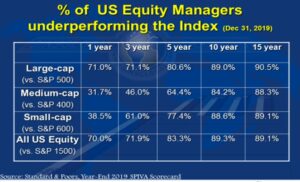

Underperformance is fairly common, and most active fund managers underperform the major indexes. Underperformance becomes increasingly more common in the long run, about 91% of active fund managers in the US underperformed the S&P 500 over 15 years.

This in part explains why the outperformance in the short term can be attributed to luck and other factors that are not directly related to a portfolio manager’s ability to pick stocks and construct a portfolio.

How to deal with portfolio underperformance

If your investment portfolio is currently underperforming, there are a few steps that you can take to deal with it and improve your performance. You need to break down your analysis into two parts: understanding why the portfolio is underperforming and what can be done to improve it.

Why is my portfolio underperforming?

The first step to take is to try to identify exactly why the portfolio is underperforming. Some of the reasons may be either exogenous or endogenous, and it is important to make a distinction between the two.

Analyze your holdings

The first step to understanding why your portfolio is underperforming is to analyze your holdings individually. Understanding whether the portfolio is underperforming as a whole or due to a few holdings should be the first part of your analysis.

One of the reasons most investors have an investing journal is to be able to track their investment thesis and to analyze things in retrospect. It allows you to compare your initial thoughts, and thesis behind the investment in the past with what is currently happening.

Understanding whether or not the investment thesis has changed should be the first part of your analysis. The next step is to understand whether the thesis changed in the short term due to the market’s price action, or if there is something structurally different with the company that can affect its returns over the long term.

There are also a few questions you can ask yourself to help you determine this:

- Is the long-term outlook for the company unchanged?

- Is there any recent news that could explain why the stock is underperforming? If so, determine whether the market overreacted to the new information, and whether or not the stock price accurately reflects these new developments.

Identify your mistakes

Analyzing each holding allows you to identify your investment mistakes, learn by understanding what you did wrong, and avoid making the same mistake in the future. It is important to understand that we all make mistakes, and even the most successful investors have made some of the worst investments in history. However, the biggest mistake is not learning from past mistakes.

Identify exactly what you did wrong, and fix it. While fixing the mistake does not necessarily mean to close a position, you need to analyze if it is better to sell or to average down.

Here are some questions that can help you to identify your own mistakes:

- Was your investment thesis flawed?

- What has changed since you initially made the investment?

- Did you ignore a specific aspect that you should have considered to be more important?

Diversification and concentration

Understanding how diversification and concentration can influence your portfolio performance in the short term is also important. A concentrated portfolio is both more likely to outperform and underperform because it is a lot more dependent on how a single asset price moves. This means that if your portfolio is concentrated on a few holdings, you could outperform and underperform for long periods of time also since your returns are much more dependent on a few holdings.

Understanding this is also important when you are analyzing the underperformance of your portfolio. Additionally, you should also consider taking either a more concentrated or diversified approach to your portfolio in order to deal with an underperforming portfolio.

Analyze your portfolio and rebalance

When it comes to investing there is more than just choosing the right stocks. Building a portfolio requires more than just picking stocks that are likely to outperform, you need to have a clear vision of what the weight of every holding should be, and how it works together.

An underperforming portfolio can be reversed just by rebalancing your holdings, based on industries, or sectors that are more likely to outperform. You should also consider your exposure to different sectors, as well as geographically.

Consider what risks could seriously affect your portfolio performance, and understand whether or not you are willing to take those risks and if they match your investment goals.

Market conditions

Sometimes due to several regions a certain sector, or a group of stocks can underperform for a number of reasons. Consider if that was the case, and what will happen in that sector or group of stocks in which you have the largest exposure.

What is a good portfolio performance?

A good portfolio performance should be in line with the benchmark that best represents the holdings you have in your portfolio. Ideally, your portfolio should be able to outperform the benchmark, and that should be your goal when picking stocks and constructing a portfolio.

Conclusion

We believe choosing your largest position should be directly influenced by both factors. You should also take into consideration your investment horizon, and try to incorporate it into your decision. On one hand, you don’t want to choose your largest holding solely based on the possible returns, but instead on the possible downside.

Otherwise, you will find yourself with a large holding that might be too risky to hold for the long term. On the other hand, you want to choose something that is safe and will most likely deliver a good long-term return.

There are several approaches to dealing with portfolio underperformance. It might happen for a number of reasons, and it is important for you to determine why it is happening. If you do so you will be able to reverse the outcome.

You will also be able to employ what you have learned and incorporate it into future investment decisions. Do not be complacent with your own mistakes, as the market usually punishes that type of behavior.