This is certainly one of the most frequent questions investors ask themselves when considering investing in stocks. The value stocks vs growth stocks debate have been going on for a long time. The answer is that there is no definitive answer to this question. In essence, you should invest in a stock, based on its ability to generate future profits. Although this seems like the most obvious and common way to conduct investment in stocks, there are other ways to make profitable investment decisions.

Value stocks

Value investors focus on stocks that have lower valuation metrics. The value investing concept was initially developed by Benjamin Graham, who focused on buying stocks that have a lower price than their liquidation value. Although this was Benjamin Graham’s approach, the concept of value investing has developed over time.

Value investors now choose stocks that might not have the metrics that Benjamin Graham looked for like low price-to-earnings and low price-to-book. The concept has evolved over time, and today value investing is much more than simply buying cheap stocks. Value investors might run into value traps, and this is a major risk to keep in mind.

Value investors also buy the so-called “growth stocks” if they estimate that the future price of the stock given its growth prospects is higher than its current price.

Growth stocks

Growth stocks tend to be companies that are growing revenues and expanding at a fast pace. They typically use their capital to continue to invest in the business and can be unprofitable for several years. Growth stocks tend to have a higher valuation, and they tend to grow more than value stocks.

Since the expectations towards growth stocks are higher than value stocks, they often deserve a higher valuation. They are inherently more risky, given that the higher valuation entails higher expectations.

Growth stocks vs value stocks

The biggest difference between the two approaches is the expectations. Value stocks are often disregarded and seem uninteresting to investors due to their low expected growth.

Growth stocks, on the other hand, tend to be among the most popular stocks in the market at any given moment. Keep in mind that value stocks often offer investors a margin of safety. In case the investment thesis does not play out like expected, the intrinsic value of the stock protects from any potential losses. Growth stocks on the other hand do not enjoy the same characteristic, and they are often more volatile and unpredictable.

Should I choose value or growth?

Well, there are several aspects to consider when asking this question. On one hand, your risk tolerance, investment horizon, and risk capacity are major concerns. If you are about to retire or already retired, growth stocks might not be the best option. As they tend to be more risky and volatile. Growth stocks usually do not pay dividends, as the company tries to reinvest all of its money back into the business.

If you are younger, growth stocks seem to be a better option, since your investment horizon is different. This is not to say that you have to choose one approach over the other. Investors can build their own portfolios with both value and growth stocks.

Some investors will solely focus on growth stocks, and some choose the other route and only buy value stocks. Neither approach is wrong. On average growth, stocks can provide you with higher long-term returns, but they usually have higher valuations. This means that if anything goes wrong with the company, or if your investment thesis does have some flaws, the stock price might decrease.

There is only one approach to stocks

Although growth investing and value investing seems like contrary approaches, they are in essence just one. An investor’s main goal is to generate a return, either through stocks growing at a fast pace, or even stocks with declining revenues and profits.

As long as the net present value of your investment is higher than the price you pay, you are making a wise investment decision. This is easier said than done, it is not always so easy to accurately calculate the net present value of every stock.

Performance over the long-term

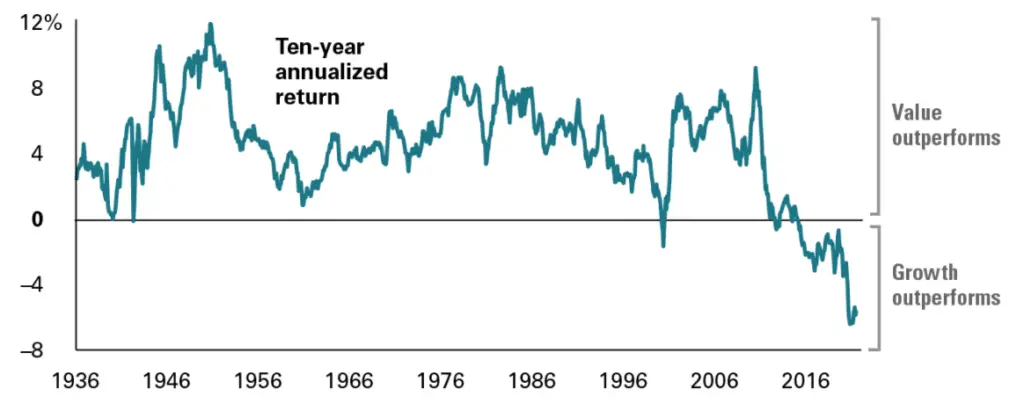

Over the last century, value stocks have overperformed. The data shows that over the long-term value stocks are more likely to outperform but it has not been the case over the last decade. This leads many people to believe that over the course of the following years, value is poised to outperform growth.

Source: investornews

Source: investornews

Although the data points to value outperforming over a long time, it all depends on which stocks you pick. There are value and growth stocks that are not going to outperform, this makes it important to conduct a thorough stock analysis before picking any stocks.

Buying growth with a value approach

Although we try to focus on value stocks, we often find ourselves analyzing growth stocks. An investment in growth stocks can sometimes be justified, depending on the price you pay for the growth. If you are paying very high multiples for a stock, the results need to match the expectations. If they do not, then you can see the value of your investment decline.

Paying a fair price or a low price for a growth company is - one of the best approaches to investing. The key is the valuation. If the valuation is not as high, and even if the expectations are not met - you still have a certain margin of safety.

Image source: groww