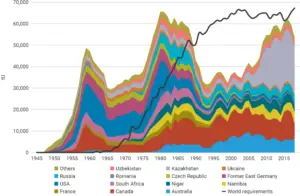

The pandemic has affected mining operations worldwide, reducing the supply driving uranium prices higher. Uranium represents roughly 10% of the world’s electricity. At the same time, it is the world’s second-largest source of low-carbon power. With 440 nuclear reactors worldwide, and with 54 under construction demand for Uranium will rise in the coming years. Since over 50% of global production comes from 9 mines in 4 countries. Producers may control the output in order for a new price to be established.

Since 2011 the price of uranium has been constantly decreasing, this has put some pressure on miners as they try to cope with shrinking margins. The recent disruptions caused by COVID-19 will negatively impact miners in the short term, while positively impacting the spot price. While dealing with lower outputs may be negative in the short-term the outlook for miners in the long term remains positive.

Coronavirus

The pandemic presents an opportunity in the uranium market since some mines had to reduce their operations, offsetting the global supply. This could lead to a supply-demand imbalance in 2020. COVID-19 has disrupted the uranium supply worldwide, creating a supply deficit. While the demand for uranium worldwide tends to be stable. The disruption caused by the virus in mining operations will undoubtedly affect the supply for 2020 through 2021. The industry revolves around supply contracts. With a lower output, miners will be forced to buy on the open market to guarantee supply for their customers. The measures that were put in place to control the virus, will definitely affect margins and increase the costs.

Impact on uranium prices

The decrease in production will negatively impact miners, increasing their cost of sales in the short term. While at the same time it can have a positive impact in the long term. As Cameco’s (NYSE: CCJ) Vice President of Investor relations referred in the latest earnings call:

“ It is true that as a result of our strategy we have become reliant on market purchases of uranium to meet our delivery commitments, but that is a deliberate choice we have made. It potentially cost us more in the near term and we have been upfront about the impact our purchasing activity is expected to have on our margins. Now, the COVID-19 pandemic is magnifying that impact.

So, why did we make the choice to rely on the market for supply? Because we believe that over the long-term, it will add significant value for our shareholders and other stakeholders and it will allow us to operate in a sustainable manner for years to come. It’s true that as uranium prices increase, purchases become relatively more expensive than production. However, as long as the near-term cost of purchasing is less than the added value we expect to capture under our strategy, we are better off purchasing.”

Source: Seeking Alpha

Sources: World Nuclear Association

Limited supply could push uranium prices higher

Many mines across the globe have been forced to suspend operations or were restricted to operate under minimal conditions. The largest uranium mine in the world, Cigar Lake, which accounts for 13% of world production, was shut down in late March. Operations are set to restart in September. The second-largest mine by output has also seen its operations impacted by the virus. The decrease in production has increased the volume of contracts purchased. As miners try to fulfill their customer's demands while protecting their reserves.

Kazakhstan represents 40% of the uranium production worldwide, the Kazakhstani government controls 81,28% of Kazatomprom the industry leader. Offset by COVID-19, recent reports point to a decrease in the output of Kazatomprom 2020’s production of roughly 4000 metric tons, the equivalent of 6% of global demand. The company issued an update in July, stating the eventual need to buy uranium in the open market:

“ Kazatomprom's production decisions and contractual obligations are backed by inventory, and the Company will continue to responsibly manage its supply sources, including purchases in the spot market if necessary, in order to meet its sales commitments (unchanged at 13,500 tU to 14,500 tU).”

Source: Kazatomprom

Block imports of uranium

On the 23rd of April, the Trump administration recommended granting the U.S. energy regulators the ability to limit imports of uranium from China and Russia. The aim would be to support the U.S. nuclear industry, which has seen its margins shrink over the recent years. Kazatomprom as a low-cost producer has the most market share in the industry. With limited imports from low-cost producing countries, the price of uranium should benefit going forward.

The same report stated Trump’s administration's intention of creating a Uranium reserve. The proposed budget would be $1.5B over 10 years. At the spot price of $32,1, it represents nearly 40% of 2019’s world production. So we could assume that going forward roughly 4% of world production should be used, towards the Uranium reserve.

Conclusion

Despite the Fukushima disaster that still looms in our memories, Nuclear Power stands as a reliable source of energy. It will continue to play an important role in the world’s power supply going forward.

In the short term due to decreased supply, spot prices for uranium are set to rise. This trend should continue into 2021. As miners return production and increase the output. On the other hand, it seems profitable for miners to reduce their operations to a minimum, as the spot price increases and drives their margins higher. Since only a few companies control most of the global supply. Restricting the output in the near term could deliver higher returns in the long term for miners and their shareholders.

We have no position in the stocks mentioned. Read our disclosure.

Featured image source: Mundoconectado