China has been growing tremendously over the past years, and this is the reason investors are investing heavily in China stocks. It is incredible how much the country has changed in 40 years. Investing has unbelievable similarities to surfing. When you are a surfer you look for places with waves. It does not mean that a place with very few waves cannot have a tsunami. The top-down approach is in a way like surfing. You look for markets where the expected growth is higher and try to ride those waves. China is currently the best investing “break”. That is why we compiled the top stocks in China for December.

The Hang Seng is one of my personal favorites indexes for three main reasons. One of them has to do with the growth the index has seen in the past. The Hang Seng has provided investors with a 16,700% return over the last 50 years. That is a tremendous performance! Making it the index with the best returns over the same time period. The second reason has to do with the taxes. Hong Kong does not charge tax for dividend payments. If you are a foreign investor, you would only have to pay the taxes in your own country. The third reason is the fact that compared with the US, Europe, and Japan, Hang Seng is currently trading at a discount.

An undervalued growth stock

Pax Global Technologies (HKG:0327) is a relatively unknown stock, that clearly deserves to be included in the top stocks in China. The payment terminal industry, also known as POS (point of sale) has a few big players that have most of the market share and Pax has been gaining market share.

Market overview

The payment terminal market is valued today at over $13 billion and it is expected to reach $51.07 billion by 2025, representing a CAGR of 25.86%. Pax Global although it's one of the smaller players has been growing at an outstanding pace. Making it one of the most interesting China stocks.

Results

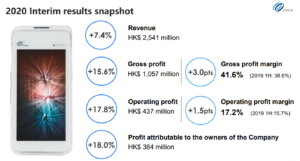

The company announced that this year profits rose no less than 40%. The positive results and the growth sent the stock soaring. In March during the sell-off, it reached a low of HK$2.5 and today it is trading at nearly HK$7. Despite the recent spike in price, the company is still deeply undervalued. It currently has HK$3/share in cash and a P/E of 5.

Despite the current undervaluation, the results for the first half of the year show tremendous growth. At the current prices, the stock is still a bargain. Management is considering the possibility of a special dividend in order to reward shareholders. It is also conducting a buyback program.

Source: Investor Presentation

The company has focused its efforts on usually overlooked markets, like Latin America and India. Coincidentally these markets have been growing and Pax has been able to reap the rewards. Despite being a Chinese company, China is actually the smallest contributor to revenues.

Source: Investor Presentation

As we can see, despite the broad negative effect the pandemic has had in multiple markets and industries. There are still companies that are positively affected by it. Due to social distancing restrictions and changes in consumer behavior, the idea of a cashless world may come earlier than expected. Pax has been able to reap the rewards and will continue to do so in the future. The stock currently has a market cap under $1 billion. It is expected that once it reaches that mark, ETFs, mutual funds, and investment banks will cover the stock in a different way. It can also trigger them to buy. We strongly believe that Pax is a bargain at these prices. Given the cash position, you are essentially buying the company for half the price.

Growing logistics stock

The pandemic has pushed e-commerce sales higher, all around the world. The largest Asian company in the logistics industry is Kerry Logistics Network Limited (HKG:0636), one of the most interesting China stocks. Two factors play a big role in the company’s success. The first has to do with the growing Chinese economy. Due to an increase in GDP and disposable income.

Chinese are now shopping more than ever, and they do it online. The second factor has to do with the pandemic. As we see not every company was negatively affected. In fact, Kerry has managed to deal with the pandemic in a very successful way.

Results

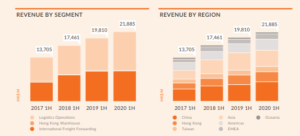

The results show a 10% increase in revenue for the first half of the year. Along with that profit rose by 29%. Results were so positive that management decided to raise the interim dividend by 22.2%. Revenues have been expanding at a decent pace, and the company has been able to gain market share across the world.

Source: Investor Presentation

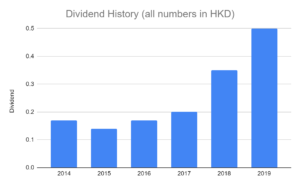

In turn, this has translated into a great dividend history. While analyzing the dividend history of the company, we can see that management has been rewarding shareholders handsomely. It should also be noted that the payout ratio has been under 40%. Leaving the company with enough cash for any unexpected situation. Nearly tripling the dividend in less than five years.

Source: Author

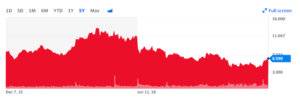

Despite the relatively high growth, the stock price has not trended in the same direction. Only recently the stock went up close to HK$17. But for most of the time since 2013, it has moved sideways.

Source: Yahoo Finance

The logistics industry, particularly in Asia. The Asia Pacific is already the biggest logistics market worldwide and it is projected to grow even more. The stock is trading at a cheap price. With a P/E under 15 and 20% of the market cap in cash, it seems like a solid buy. If you consider the valuation, and the cash and cash equivalents, you are essentially getting a 20% discount. Add to that the fact that it is trading close to book value and you have yourself a bargain.

An old airport has value

Anything that has to do with flight travel has been deemed very risky since March. Independently of that, the aviation industry will eventually return to its former glory days. With that airports should also benefit. Beijing Capital Airport (HKG:0694) is one of the safest value stocks that can be found on the Hang Seng. The airport is the second busiest airport in the world. Until 2020 it received over 100 million passengers every year. But the stock price has been trending lower for two main reasons. On one hand, the pandemic had a terrible impact on the business, and at this point, it seems there will only be losses in 2020. While the pandemic had its effect, the stock has been losing its value since mid-2017, and for a good reason.

Source: Yahoo Finance

Due to the high number of passengers, the airport was near its full capacity. For that reason, the government decided to start building a new airport in Beijing. It would later be called Beijing Daxing International Airport, the world’s largest airport. Beijing Daxing Airport would start receiving commercial flights in 2019.

Results

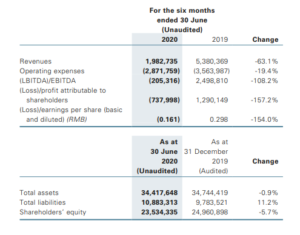

The results for the first half of 2020 have been nothing short of terrifying. Revenues went down 63.1% YoY, earnings per diluted share collapsed 154% to a loss of RMB0.161 per share. As the number of passengers decreased so did the company results. Passengers' decrease represents 73.58% YoY. Forcing management to halt the interim dividend. Given the opening of the new airport, commercial flights will be split between the two. And taking into account the lack of passengers this year, the company has been losing money. It is still unclear when things will return to normal if they ever will. Even if they don’t, Beijing Capital Airport is still an interesting stock. The stock trades around book value, and it has very little debt.

Source: Interim Report

Out of the three China stocks, Beijing Capital Airport is the one that offers the most risk. Given the uncertainty surrounding the industry in the short term. It is difficult to project when the company will return to its former glory and profitability. The fact that Daxing Beijing Airport is now operating is also impacting the company negatively. Considering the negative outlook and uncertainty, the stock should be considered if it reaches HK$5. At that price, there is a considerable margin of safety, and given the past stability of the business, it seems attractive.

HERE are 8 ways to find undervalued stocks

We are long 0327. Read our disclosure.

Featured image source: Straitstimes