When you think of the term “paper hands” what comes to mind? For many people, it is likely something to do with the stock market and crypto. But what do paper hands actually mean?

In this article, we will explore the meaning and origin of this term. We will also discuss the difference between diamond hands and paper hands.

What does it mean to have paper hands?

The term paper hands generally refer to investors who are not willing to hold onto their stocks or crypto for a long period of time. They are more likely to sell their shares quickly, even if it means taking a loss.

Paper is a material that is easily torn, and in the same way, paper hands investors are easily spooked by small changes in the market. They lack the patience and fortitude to weather storms and ride out dips.

Paper hands origin

It is believed that the WallStreetBets community on Reddit originated the term "paper hands." This group is known for “trolling” the stock market and trying to drive up the prices of certain stocks.

Trolling refers to deliberately provoking or annoying people online. It is no surprise that the term "paper hands" is used negatively, as it implies that the investors are weak-willed and quick to sell.

This term is often used in cryptocurrency as well because investors are quick to sell their digital assets at the first sign of trouble. And signs of trouble occur often as the industry is volatile and new when it comes to regulations.

What does paper hands Portnoy mean?

In reference to the stock market, "Paper hands Portnoy" is a phrase that has been popularized due to Dave Portnoy, the founder of Barstool Sports. The phrase is used to describe investors who are quick to sell their stocks at the first sign of trouble.

Dave Portnoy received this nickname after he sold his meme stocks. This is because the AMC and GameStop investor community is light-hearted and enjoys having fun with the stock market and its participants.

What is a diamond hand?

Diamond hands are the opposite of paper hands. They are investors who are willing to hold onto their stocks for a long time, even if it means taking a short-term loss.

Diamonds are very strong and hard to break, and in the same way, diamond hand investors have a strong conviction in their investments.

They believe that eventually, the market will rebound and they will come out ahead in the long run.

Diamond hands vs paper hands

As we mentioned before, diamond hands are the opposite of paper hands. They're investors that are prepared to keep their equities for a long time, even if it means losing value in the short term.

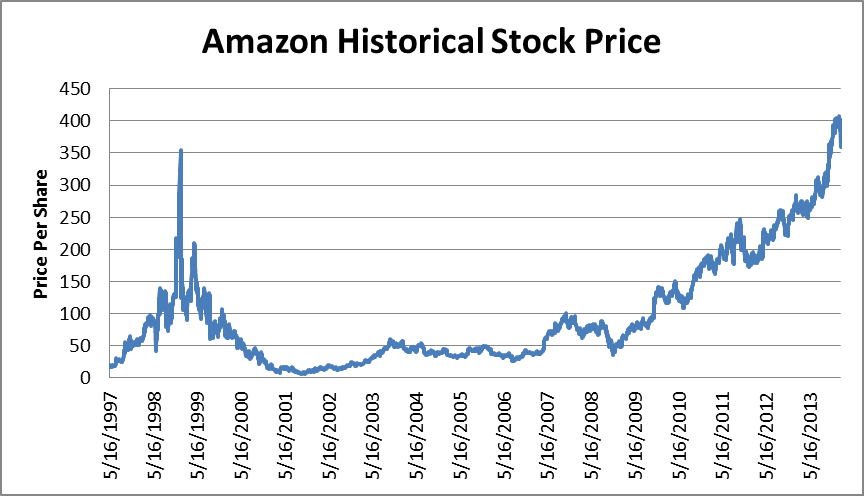

An example of diamond hands would be an investor who bought Amazon and held onto their shares even when the stock was down 90% following the dot-com bubble collapse.

Source: Seeking Alpha

By having diamond hands and holding onto their shares, they were able to make a fortune when the stock eventually rebounded. In contrast, paper hands investors would have sold their Amazon shares as soon as the stock started to dip.

They would have missed out on the rebound and made a loss instead of a profit.

Which one is better to have?

If you are a value investor and your thesis is still sound. Then, it might be worth developing diamond hands. This is especially true if the company's fundamentals are improving and the stock price is mostly driven down by emotional investing.

Having 'diamond hands' can help your wealth compound over the long term. It can also help prevent you from selling at a loss. However, diamond hands can also cause investors to hold onto investments that have reached their peak.

In this scenario, it might be better to have paper hands. Paper hands are better to have if your investment thesis has changed or you no longer believe in the company. In this case, it is better to take your losses and move on. Paper hands are also better to have if you need the money for an emergency.

For example, if you find yourself in personal debt, it may be better to sell your stocks and use the money to pay off your debts. If you are someone that prefers to take money off the table and reap the rewards of your early positions, then paper hands may also be the way to go. Overall, it really depends on your investment strategy and risk tolerance.

'Diamond hands' are better to have if you can afford to lose the money and have a long-term investment horizon. For example, if you are investing for retirement, you may be willing to hold onto your investments for 20-30 years. If you are already retired and it is clear that the stock is in trouble, it may be better to have paper hands and take your money out while you still can.

Conclusion

The bottom line is that there is no right or wrong answer when it comes to 'diamond hands' vs 'paper hands.' However, by understanding these two terms, you can navigate through the investing community with ease.

It can be helpful to network with other investors but don't let their nicknames and “trolling” influence your investing decisions. Have fun but don't forget to invest intelligently with care.