Mr. Market is a fictional character used as a metaphor to describe the stock market. The term was coined by Ben Graham, in his highly acclaimed book The Intelligent Investor. The Intelligent Investor is among the best fundamental analysis books ever written.

Ben Graham describes Mr. Market as a highly irrational figure, capable of showing a wide spectrum of emotions. Its irrationality and lack of self-control drive him to behave euphorically, and frantically sometimes. It is also able to be fearful, greedy, moody and panic.

A manic-depressive character

Ben Graham used Mr. Market as the perfect metaphor for how stock prices fluctuate. The stock market is in essence driven by both buyers, and sellers. Both sides of each trade think they are making the right decision whether they sell or buy.

“Imagine that in some private business you own a small share that costs you $1,000. One of your partners, named Mr. Market, is very obliging indeed. Every day he tells you what he thinks your interest is worth and furthermore offers either to buy you out or to sell you an additional interest on that basis. Sometimes his idea of value appears plausible and justified by business developments and prospects as you know them. Often, on the other hand, Mr. Market lets his enthusiasm or his fears run away with him, and the value he proposes seems to you a little short of silly.” - Ben Graham

Investors can be highly irrational, and being able to understand that is important. As an investor, it is difficult to predict how other investors will behave. It is also impossible to control the price fluctuations. So what we can do as individual investors is to remain highly rational, and control our emotions. We can also try to take advantage of irrational investors' behaviour.

Mood swings

Mr. Market mood fluctuates in the same way stock prices change. He reflects the sentiment of ordinary investors in the market, who let their emotions take the best of them. Therefore, Mr. Market can be highly fearful and anxious. It can suddenly change his mood and become irrationally exuberant.

When to take advantage of Mr. Market?

According to Ben Graham, there are two ways in which an investor can take advantage of Mr. Market’s behaviour. One of them is when Mr. Market is highly optimistic, and euphoric. This leads to high stock prices and can present wise investors with an opportunity to sell. The same can happen when investors get extremely fearful and anxious. If that is the case, stock prices will decline and investors should take advantage of that by buying.

“The intelligent investor is a realist who sells to optimists and buys from pessimists.” - Ben Graham

Ben Graham’s view of Mr. Market, is that price fluctuations are driven by investors’ emotions. As an investor, there is nothing you can do about it. All we can do is focus on the business behind each stock. Over the short term, sentiment drives price fluctuations. Over the long term, the price is dictated by the business financial performance.

Warren Buffett on Mr. Market

Warren Buffett is known as a Ben Graham disciple. Having worked for Ben Graham has helped to shape Warren’s investment view. He also describes The Intelligent Investor, as the most iconic book on investments. Warren Buffett has also been an advocate of exerting extreme emotional control when it comes to investments. His success is attributed in part to this. His ability to control his behaviour, and remain rational in periods of extreme panic has contributed to his success.

Mr. Market and the efficient market hypothesis

The metaphor used by Ben Graham contradicts the generally accepted efficient market hypothesis. Although markets are usually efficient, that does not mean that there are no moments where it is not efficient. The fact is that most of the time the market efficiently prices in most of the available information. Despite that, there are times when the market displays extreme emotional reactions to certain events. This is when you can take, and should take advantage of those periods.

These inefficiencies are what allows some investors to consistently beat the market.

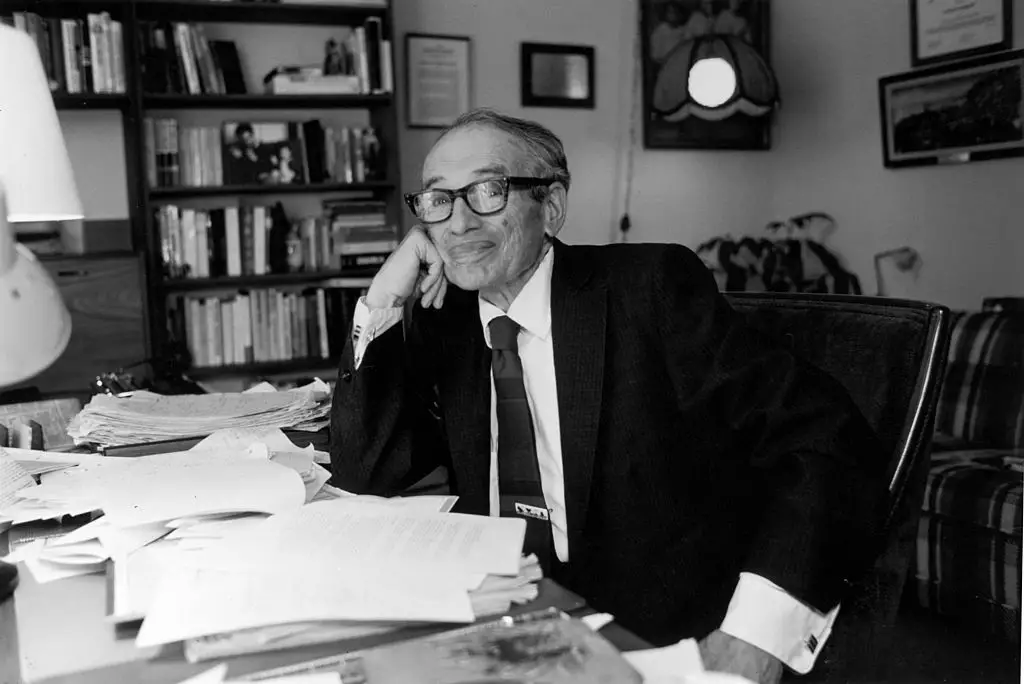

Image source: medium