Fundamental analysis books are perhaps the best way for upcoming and seasoned investors to read. As an investor reading is an important step to learn and broaden your knowledge of markets. However, it can be difficult to choose the right books to help you on your investment journey.

Being able to learn from the best sources is also an important part of the process. There are plenty of investing books out there to choose from, but only a handful of them are actually outstanding knowledge sources. Without further ado, here are the best fundamental analysis books for investors.

The Intelligent Investor, Ben Graham

Perhaps the most essential book for investors is Ben Graham’s timeless The Intelligent Investor. This iconic masterpiece has been useful for decades. In fact, the teachings found in this book make it perhaps the most important book ever to be written on fundamental analysis. The layman's approach to the concept of value investing is still widely applicable today.

Ben Graham describes his investment approach, in looking for cigar butts. The book was so influential, that Warren Buffett describes it as:

The several chapters in the book will guide investors through the process of selecting and analyzing securities. It also describes in detail, the common misconceptions about the stock market, and how psychology influences price action.

Security Analysis, Ben Graham and David Dodd

If there ever was an investment bible, Security Analysis would surely be it. The book written nearly 100 years ago by Ben Graham and David Dodd is perhaps the most significant contribution to investment literature. Although it was released in the 1930s, the book is still very useful today. The concepts and teachings can still be applied in today’s market. Over the years, a number of revised editions have been released. With the intention of updating and reviewing some of the concepts, so they can better reflect today’s world.

Security Analysis explains the process by which an investor should select and analyze securities. It also teaches investors how to value different businesses, and how to use financial statements to their advantage. It is such an insightful book that it is widely used by university students. Security Analysis is definitely one of the most influential fundamental analysis books.

Common Stocks and Uncommon Profits, Phillip Fischer

Phillip Fischer is another iconic investor, which has deeply influenced Warren Buffett. Although Warren Buffett tends to attribute most of his investment success to the teachings of Ben Graham. Phillip Fischer was also a highly important part of shaping Warren’s investment strategy.

There are some stark differences between the approaches of both Phillip Fischer and Ben Graham. Ben Graham would put much more emphasis on the price of a particular stock. Most of the time he would calculate its intrinsic value, assuming a liquidation. Phillip Fischer on the other hand focused on the qualitative part of the business.

Putting more emphasis on the operational aspect, and the competitive advantages. Fischer also leans towards long-term investing, as opposed to Ben Graham. Due to the nature of the businesses Ben Graham would sell stocks after they appreciated in price. Phillip Fischer on the other hand is known for holding stocks over a very long period of time.

Both authors have shaped Warren Buffett’s investment views, and both strategies are still widely applicable today. Phillip Fischer’s “Common Stocks and Uncommon Profits”, explains in detail what process an investor should go through to analyze the qualitative aspect of a business. It outlines what questions you should ask yourself when you analyze a particular stock. The book also characterizes which companies have a competitive advantage over their peers, and how investors can determine those competitive advantages.

One Up on Wall Street, Peter Lynch

Peter Lynch is one of the most revered fund managers. Known for managing the Fidelity Magellan fund for 13 years. He managed to achieve a 29.2% annual return, making him one of the most successful fund managers ever on Wall Street.

Peter Lynch also has an amazing ability to explain complex and detailed investment concepts in layman terms. This allows investors to understand the simplicity of his investment ability, and approach. One Up on Wall Street is by far one of the most important books for investors starting out. Although it was published some years ago, the market has changed a lot since then. You will still find a lot of important concepts, and it will help in shaping your investment mindset.

Beating the Street, Peter Lynch

Released a few years after One Up on Wall Street, this book is another masterpiece. Peter Lynch goes over different topics and approaches them in a way that is easy for every investor to understand. It is easily among the best fundamental analysis books ever written. Beating the Street is a must-read for those interested in the stock market. Here is Peter Lynch, on one of his most iconic presentations:

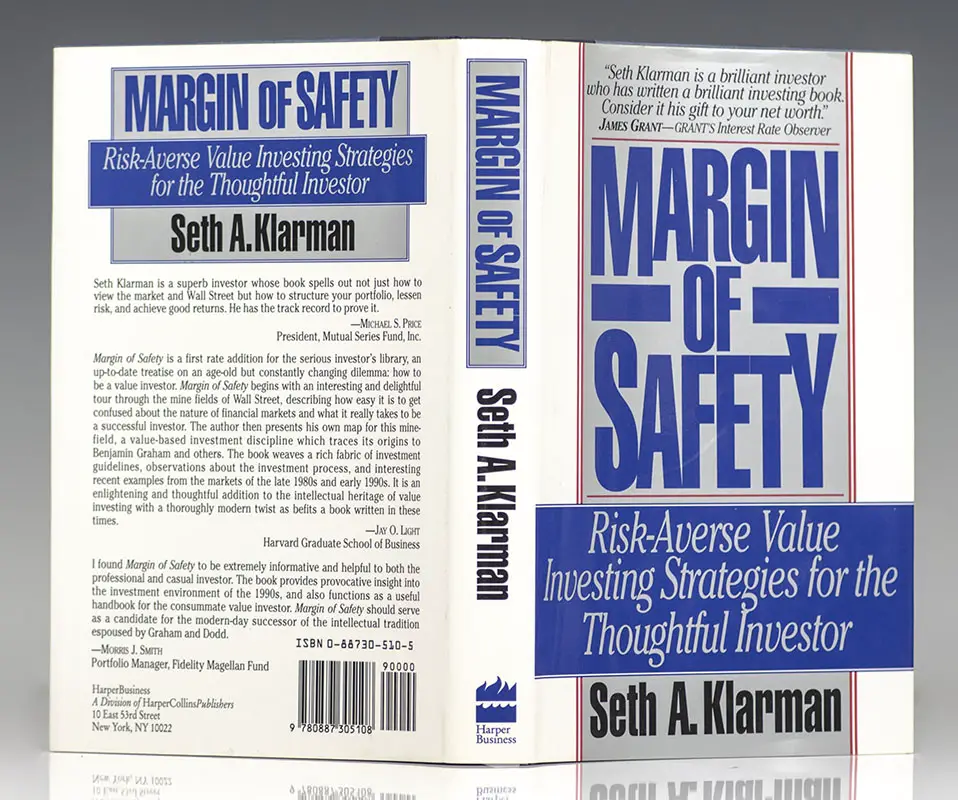

Margin of Safety, Seth A. Klarman

Margin of Safety, Seth A. Klarman

Seth A. Klarman is also a fund manager with a stellar performance over a long period of time. He has embraced Warren Buffett’s teachings and employs his own personal style. Margin of Safety has become an incredibly collectible book among investment aficionados. The first print contained just a few copies, and since then the first edition of the book has been highly sought after.

Seth A. Klarman uses a value investing approach, based on fundamental analysis. Similar to what Ben Graham has used. Valuing businesses based on their margin of safety. The idea behind the concept is that if you invest in a business that has a margin of safety, you will hardly lose any money.

Stocks for the Long Run, Jeremy Siegel

Another important book for long-term investors is Stocks for the Long Run. Jeremy Siegel presents a detailed analysis of how to pick stocks for the long term. The book is highly driven by historical data, which justifies why a long-term investment approach is the best strategy to invest in the stock market.

When it comes to picking stocks, as investments for the long-term there are a few key aspects that investors should look for. With the help of this book, you will be able to quickly discern between stocks that are appropriate for long-term investment and those that are not. Stocks for the Long Run is among the most important fundamental analysis books for long-term investors.

Warren Buffett and the Interpretation of Financial Statements

This is perhaps one of the most important books to read if you are new to investing. As an investor, you need to be able to understand financial statements. Warren Buffett and the Interpretation of Financial Statements is one of the best fundamental analysis books to understand accounting.

If you do not have an accounting background, it is extremely important to understand the basic concepts of accounting. This handbook can be finished in a day, and it contains very important concepts that you can apply as an investor.

Being able to analyze a stock is much more than just looking at the price. You have to be able to dig into its financial statements and assess the business behind the numbers. This little book is a great starting point for those of you who are about to embark on an investment journey.

It explains not only all of the accounting terms used in financial statements, but it also outlines the most important things Warren Buffett takes into consideration when he analyzes financial statements.

Image source: unsplash