Some stocks are well known and some fly completely under the radar, that is the case of C.P. All PCL (OTC: CPPCY). CP All is among the largest chain of convenience stores in Thailand, it has a license to use the 7-Eleven trademark. It is one of the subsidiaries of Charoen Pokphand, a large family-controlled conglomerate that is involved in several industries.

CP All is also the majority shareholder of Siam Makro (BK: MAKRO). In 2013 CP All acquired Siam Makro, a Thai chain of cash and carry stores. The $6.6B deal allowed CP All to diversify its operations. It still has a stake of ~93% in Siam Makro.

Although this stock is not so widely covered we think it deserves some attention for inventors looking for global exposure. CP All has competitive advantages in the region and will continue to grow its number of stores. Over the past two decades, it was able to grow exponentially. Although past performance is not an indicator of future performance, we think the stock should be on every invertor’s watchlist.

CP All's Astonishing past performance

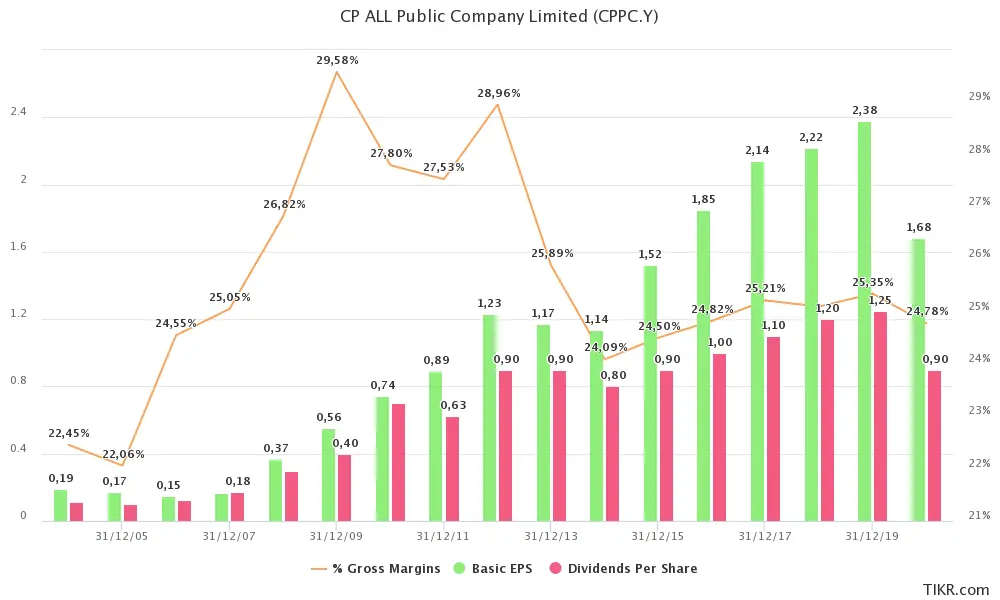

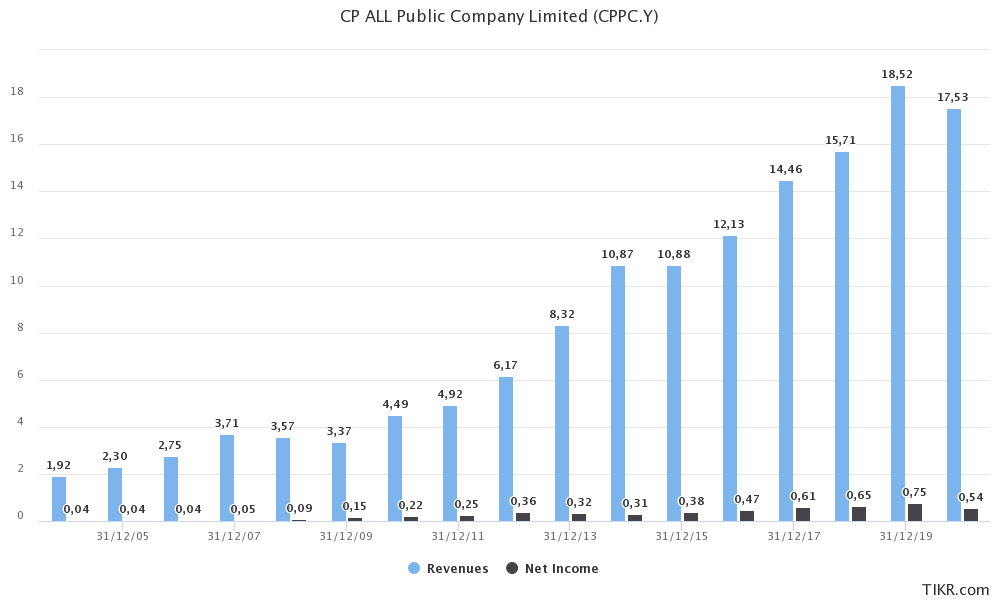

CP All past stock performance is nothing short of impressive, it has been growing sales at a CAGR of 14.82% since 2005. In 2005 it had ~$2.3B in sales and net income of ~$40M, the stock could be bought for as low as THB2.8, on the Thai exchange. At the time $1 dollar was worth ~THB41, today it is worth ~THB31.2, which also adds to the returns.

With $10,000 invested at the time, you could have bought ~146,420 shares, it would be worth today ~$281,580 without the dividends included. The dividends would have amounted to ~THB11.39 per share or ~$53,000. A total return of ~3,250% in 15 years, is not bad at all.

The pandemic naturally affected revenues and profits, with revenues dropping ~5.4% to ~$17.53B. In turn net income decreased by ~28% to ~$540M.

CP All's Tesco Acquisition

In 2020, Tesco(LSE: TSCO) was looking to sell its Thai and Malaysian stores. There was considerable interest from multiple parties. Charoen Pokphand Group eventually presented the most appealing offer. The deal, valued at over $10B, will give CP Retail control of 86.9% of Tesco Thai stores and 100% of Malaysian Tesco stores. CP All controls 40% of CP Retails.

The numbers later reported showing that the deal was made for ~$10.6B. It included ~1,900 stores in Thailand and 70 stores in Malaysia. The Tesco brand will be replaced with Lotus.

CP All Stores

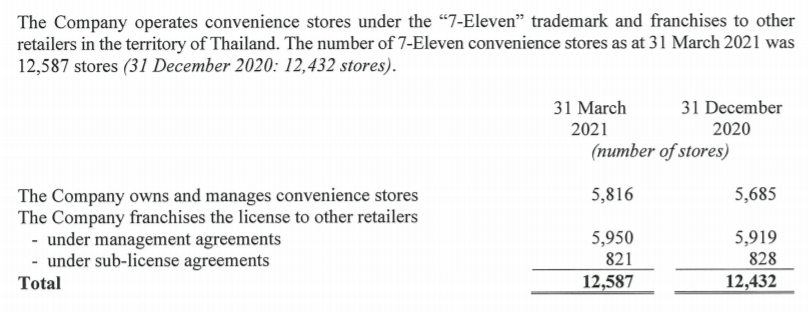

CP All not only has its own stores but it also offers franchises and engages in management agreements with some of them. As of March 2021, the total number of stores was 12,587. With ~46.2% of its stores being fully owned and the remainder being franchised. Of the franchisees, ~88% are under management agreements.

Source: Quarterly Report

Results Q1

This year CP All should return to its 2019 performance. Although vaccination is happening slower than in some other countries, it has finally started. Q1 results show that revenues are still down ~8.5% compared to YoY. Net income also decreased by ~54% compared with 1Q20.

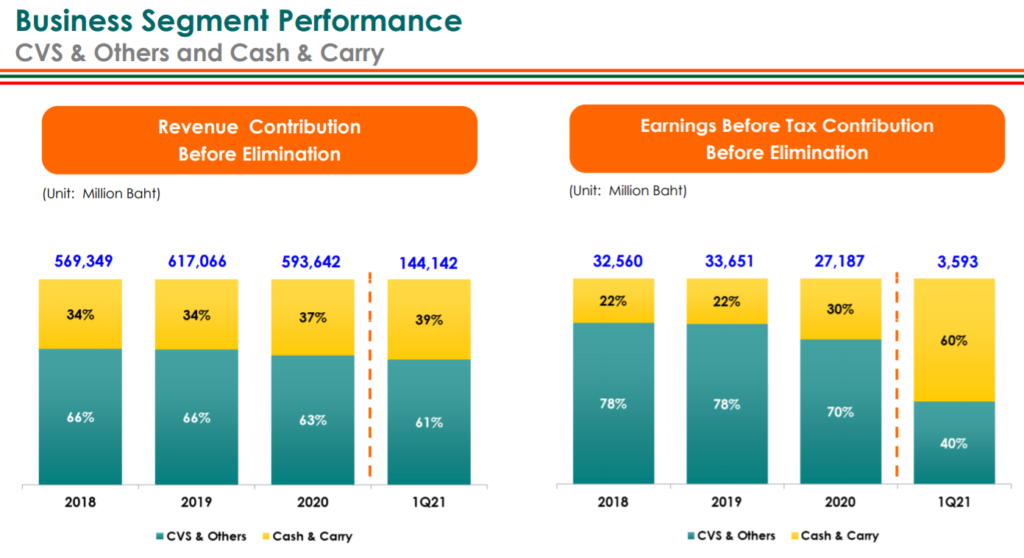

What stands out the most is the fact that Siam Makro seems to be the best performing segment at the moment. Siam Marko contributed ~22% for the earnings in 2018 and 2019, and in this last quarter, it accounted for 60% of earnings. EPS was THB0.26, compared with THB0.6 in 1Q20.

Source: Q1 Presentation

CP All has continually expanded its number of stores over the last few years. Adding an average of ~720 stores per year. In Q1 it added 155 new stores to its portfolio, this should also contribute to the top and bottom line. It also leads us to believe that although the 2019 results might not be achieved this year. With the constant expansion, it should achieve the same or even better results in 2022.

CP All Valuation

It would be unfair to value CP All based on last year's results. The pandemic took a significant toll on the convenience store business, which is expected to rebound. For that reason, it is better to use 2019 results to reach a fair value. As revenues and earnings should return to those levels by the end of 2022.

Revenues in 2020 declined ~4.5% to ~$16.91B and net income decreased 29.2% to ~$490M when compared with 2019. If we assume an expected net income for 2021 in line with 2019, the price-to-earnings ratio is ~25. If we use the 2020 earnings the price-to-earnings is ~34. It currently trades at a price-to-sales of 1.

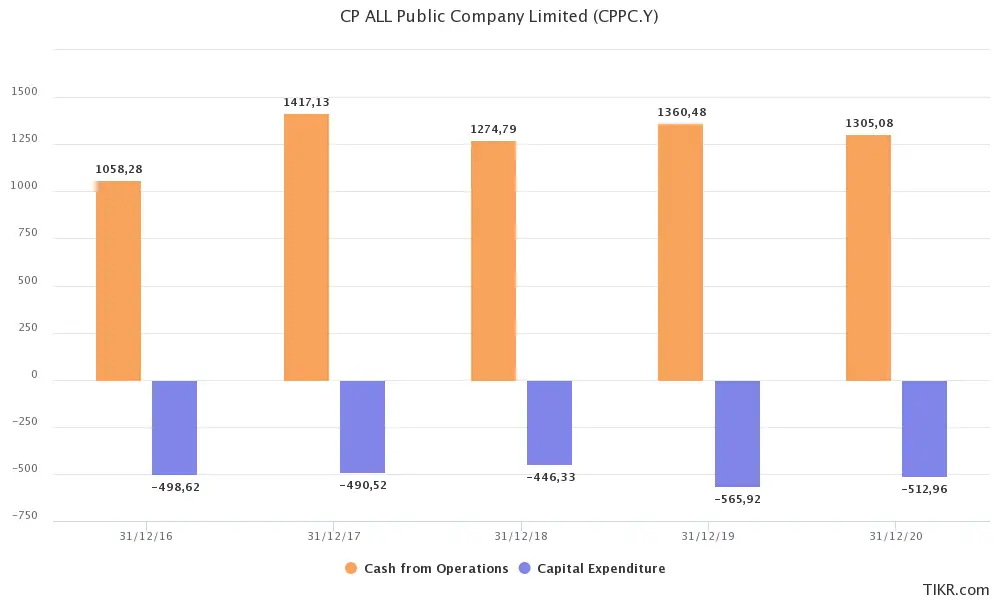

CP All has improved its free cash flow over time, in 2020, it still had ~$800M in free cash flow. It trades at ~20x free cash flow.

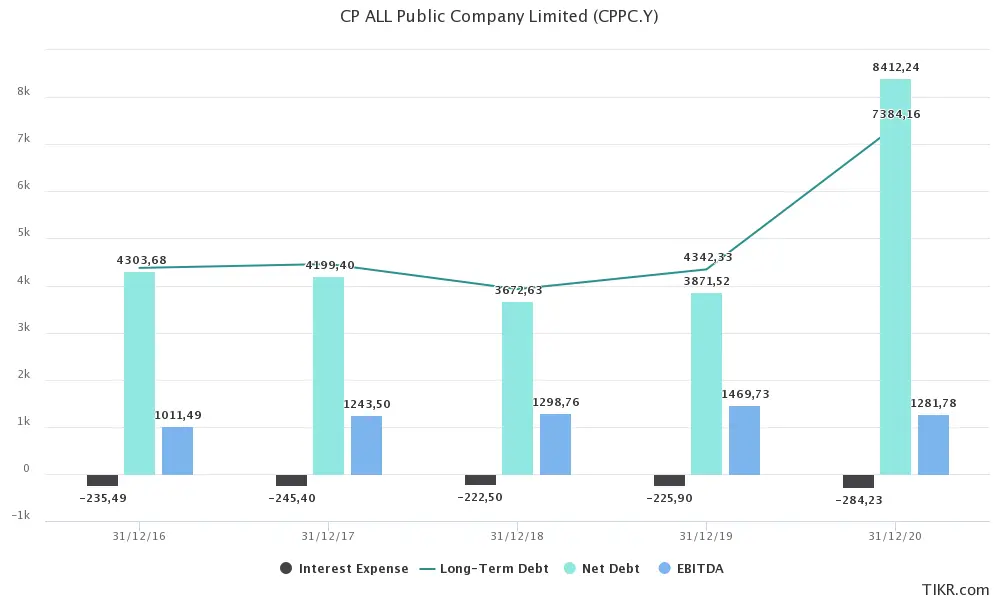

Due to the Tesco acquisition, CP All’s balance sheet has a considerable amount of debt. A total of ~$7.38B in long-term debt, it nearly doubled since 2019. Interest expenses also increased 25.8% compared with 2019 to ~$284M.

For a market cap of ~$16.57B, it seems the debt level seems somewhat excessive. It will be important to see at which rate CP All starts paying back its debt, over the next few quarters. It still holds ~$1.18B in cash, so there should be no problems in the short term.

CP All Risks

Reputational risks

At the time of the Siam Makro acquisition, CP All insiders were caught trading shares in the company. While holding insider information about the acquisition, they started accumulating shares. As soon as the announcement came in, Siam Makro shares rose close to the bidding price. The Thai Regulator fined the executives involved. Although this type of behavior should not be allowed at such a high corporate level, CP All ended up sweeping the problem under the rug. There were no consequences for all the executives involved. CP All’s excuse was that it would be difficult to replace all of the executives.

Price

At this price, there are certainly more value-oriented stocks. Although we think a higher quality company like CP All should trade at higher multiples. The growth over the future might not be like in the past, and that is something to consider with this stock. At this valuation, the positive long-term outlook seems to be already priced in. There is no margin of safety.

Increased debt

The pandemic affected CP All’s business. With imposed lockdowns and social distancing restrictions, convenience store businesses suffered. With revenues declining as well as profits. CP All increased its long-term debt, mainly due to the acquisition of Tesco.

Although the leverage ratio of the company in itself is not an alarm sign, it is something to keep an eye on over the next quarters.

Investors should also be aware of the THB exposure, and the currency risks of investing in CP All.

Final Take

CP All stands out as a well-managed company and a true compounder over the last two decades. Although it is difficult to extrapolate exactly what the performance will be like in the coming years, the outlook looks very positive. The current valuation is slightly higher than what we would consider for an investment. For that reason, we will keep following the stock, and wait for a more attractive valuation. It will also be important to see how the results in 2021 will be, and the outlook for 2022.

At this point CP All will be on my watchlist. Monitoring the price until it offers a higher margin of safety seems to be the best option. Another aspect to keep in mind is the fact that the company might be following an inorganic growth approach. At least the Tesco acquisition signals that to some extent. This could mean that the ability to further expand its business organically might be limited.

We have no position in any of the stocks mentioned. Read our disclosure.

Featured image source: FT