Kellogg Company (NYSE: K) needs no introduction, the company is known worldwide for its food products, established over 100 years ago and it has been paying dividends consecutively for 96 years. Given the current sky-high valuations, Kellogg's is fairly valued and might offer some downside protection in case of a downturn.

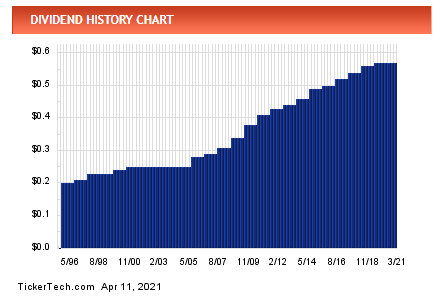

The stock price although has increased significantly in the past two decades, it lagged compared with some of its peers. It has returned ~150% since 2001, which represents ~7.5% return per year. Although the company seems very stable, the slow growth is reflected in the stock price and valuation. Despite that dividends have been stable and have nearly tripled since 2005.

Source: Dividendchannel

Source: Dividendchannel

Kellogg's Overview

Kellogg's focuses on packaged foods, and the company is present worldwide. With well-known brands, the company has been a stable dividend payer since the ’90s. The lack of growth is one of the reasons the stock price has not appreciated considerably. Once the most common breakfast food, cereal is slowly being replaced by other foods. Over the last 20 years, Kellogg’s was able to adjust to the change in trends. At the turn of the millennium, cereal made up over 60% of Kellogg's sales and has slowly declined. The snack segment is now the biggest contributor to sales and earnings, at slightly over 50%.

The company has successfully diversified its segments over the years, especially through acquisitions. The most notable one is Pringles, which Kellogg's acquired from Procter & Gamble (NYSE: PG) for $2.695B.

RXBAR, a company focused on protein bars was also recently acquired for $600M. So far it seems that the acquisition was very beneficial for Kellogg's. Despite the lack of organic growth, management seems to be monitoring food trends closely and looking for key acquisitions that ensure the company stays competitive across multiple segments.

Management has also looked to diversify its operations geographically. The recent acquisition of the African joint venture Tolaram Africa Foods is a good example. The company is trying to capture growth by increasing its presence in emerging markets, which should drive most of the growth going forward.

Kellogg's Short Interest

As food trends change, it is undeniable that Kellogg's will face challenges going forward. The organic and healthy food trend is here to stay, and consumers are deterred from buying packaged foods. As sales of packaged food decline in some developed countries, there is a need to adjust to consumer preferences. Millennials seem to be adopting the healthy food trend, and their food choices are not so influenced by brands, as their parents were. Breakfast choices are now much different than what they were 20 years ago, and it has led some to question the sustainability of Kellogg’s.

This explains in part the high short interest in Kellogg's, currently at ~7.96% of the float.

2020 Results & Valuation

The pandemic helped the company increase sales in organically 2020 by 6% and report better than expected results for the year. As more people stayed at home during the lockdown, and eventually opted for Kellogg’s products, they have a prolonged shelf life.

The S&P 500 currently has a price-to-earnings ratio of ~42. The price-to-earnings of Kellogg's is ~17. This means the overall market earnings are priced ~150% higher than Kellogg's. The forward price-to-earnings is ~15.5. Given the slow growth of the past two decades, it simply means that investors are willing to pay a lower price for Kellogg’s earnings going forward.

Kellogg’s revenues have been stable for the most part of the last decade, hovering around $12.9B to ~$14.2B. Ending 2020 with $13.77B in revenues, and diluted EPS of $3.63.

In 2020 the company achieved ~$1.48B in free cash flow, which given the current market cap of $21.3B trades at 14.4x free cash flow. EBITDA for 2020 was $2.33B, Kellogg's trades at ~9.2x EBITDA.

Kellogg's Balance Sheet

Looking at the balance sheet, there are a couple of items that caught my eye. On one hand, the company has a total debt of $8.14B, which is fairly high, given the EBITDA and free cash flow. Nonetheless, given its stable outlook, the interest expense in 2020 was ~$281M. It seems that Kellogg's is paying on average ~3% interest on its overall debt. Although it is not a great indicator, the company should have no problem paying the interest on its debt.

With ~$5.8B worth of goodwill, there could be some impairments in the future. It is difficult to predict, but some of the value might be overstated. Kellogg's is highly dependent on the intangible value of its brands to generate sales and earnings. If at some point in time, the value of its brand portfolio declines, investors could see their initial investment losing part of its value.

Under $60/share, it seems like a defensive investment that should reward patient investors with a dividend yield close to 4%. The payout ratio for 2020 was ~66%, which gives the company enough room to reward shareholders and deploy additional capital to further its growth prospects.

Kellogg's Risks

Inflation & Food Prices

Although the CPI has remained somewhat stable, which has led many to question its reliability as an inflationary indicator. Some argue that CPI does not reflect inflation. There are countless reports of higher food costs since 2020. Food commodity prices just hit a six-year high, and are expected to continue climbing higher.

Given the recent surge in commodity prices, K may face some pressure as it becomes increasingly costly to source the main ingredients for its products. Although it could affect its margins in the short-term, as a long-established brand K has enough pricing power to significantly adjust prices accordingly.

Brand Value

Kellogg's is highly is dependent on its brands to generate revenue, this could pose a threat. It is essential that the company’s brands remain among consumer preferences. Any decline in its brand value could affect revenues and earnings.

Final Take

The stock is fairly priced considering the high valuation present in the market. For investors that are retired or have an investment profile that makes them stay away from risky investments, Kellogg's could be an interesting addition to your portfolio. In the meantime, you can collect the ~3.7% dividend yield, which given the stable outlook and defensive nature of the stock seems attractive.

Given the yield on treasuries, the stock seems like an interesting option to park some money for a while. The lack of growth could deter some investors, but for retirees or risk-averse investors, it could be an interesting addition to their portfolio. Future growth seems to be highly dependent on strategic acquisitions.

We have no position in any of the stocks mentioned. Read our disclosure.

Featured image source: Mercadoeconsumo